Neo-Effisend

NEO based mobile DApp and Wallet that improves Cash out processes and integrates it with Rapyd (biggest payment processor in the world) to improve financial inclusion in Mexico and Latin America.

Almost 4 years ago Vitalik Buterin, co founder of Ethereum posted in twitter this message:

At that time it grabbed the attention of almost the entire crypto space and the answers regarding that question were mostly a big “Not many if at all”. Of course, there have been isolated projects that try to work with the developed world with several big names attached, but not to much avail. Cryptocurrencies and blockchain technology from that time onwards has mostly been used by a few early adopters and some others, but were mostly already banked, educated people, even in the developing world.

Now, let’s ask that same question today; How many unbanked have we banked by the year 2021? Despite having made great progress and having outliers like the country of El Salvador, outside of that, the progress is almost null. Most of the same people that are into crypto today have been in for years and are the same elite, educated, previously banked ones, it has not reached those who are not.

We can say that because our team lives in one of those developing countries that countless projects try to portray as a target for financial inclusion, which is Mexico.

And yes, Mexico is the perfect target as it is the largest issuer of remittances from the US and it will break $42Billion this year alone.

Of course, remembering that the US is the biggest sender of remittances in the world.

It is important to mention that, according to the World Bank, 65% of Mexican adults do not have any type of bank account and only 10% save through a financial institution, in addition to the fact that 83% of Mexican adults do not have access to electronic payment systems. These circumstances limit the potential of the sector to place the resources of savers in productive projects that generate economic development and well-being for the population. And crypto is not doing better than the legacy system, most of the users are people like our team, tech savvy with a certain degree of education and already banked.

Regarding NEO

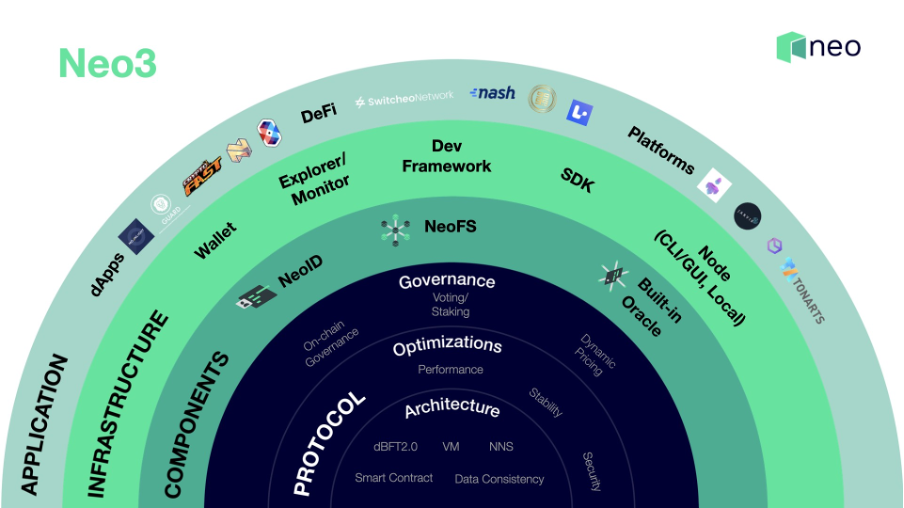

Now enter NEO. We inspected the ecosystem completely and found that the project is perfect for fast, easy and almost fee-less transfers with a booming ecosystem and several projects in Defi 2.0 and the NFT space. In addition to that we know that if we decide to focus on the problem presented we have to do this mobile-first as 76% of the population has a cell phone and uses that primarily.

Despite all the potential of NEO and its ecosystem, we found great problems with their Cash-out ramps. Xbox, Uber, google play and cell phone payments? Sorry for being aggressive, but this does not work for that unbanked population in any way, this is more for the “already banked” elite populace. Most remittances are done electronically yes, but through services like Western union where the families can get cash. This will never talk to them.

But I think that with certain systems that are already in place and the great potential of NEO we can produce a Dapp that does that cashout part correctly, directed at that populace, and improve on financial inclusion.

Regarding the planathon feedback, what we did and What's next..

This application is directed at those who cannot benefit directly from cryptocurrency. It has the usual, both crypto and fiat wallets, transfers between crypto and fiat, transfers between crypto accounts and it gives a spin on the cash in - cash out portion of the equation as no other project provides it. It is very important if this application is going to benefit and bank people to be very agile and compatible with FIAT at least until crypto reaches mass market. Most of the developed world has not even incorporated to legacy electronic systems.

I think we can make the jump from those systems almost directly to self-banking, such as the jump that was made in some parts of Africa and even here in Latin America from skipping telephone landlines directly to Mobile phones. If that jump was made from that type of technology this one can be analogous and possible.

Perhaps the most important feedback of the Planathon part of our submission was that although this is a brand new market that Neo has no exposure to, we had to show how our application will ensure the enforcement of anti-laundering laws.

We will do that will strong KYC. And at the same time Mexico has published since 2018 strong laws to manage that including its fintech law.

Quoting: " The Mexican FinTech Law was one of the first regulatory bodies created specifically to promote innovation, the transformation of traditional banking and credit financial services that would even allow the possibility of incorporating exponential technology such as Artificial Intelligence, Blockchain, collaborative economies and peer-to-peer financial services in secure regulatory spaces. "

All of this was a silent revolution that happened in this jurisdiction after the HSBC money-laundering scandal that included cartels and some other nefarious individuals. https://www.investopedia.com/stock-analysis/2013/investing-news-for-jan-29-hsbcs-money-laundering-scandal-hbc-scbff-ing-cs-rbs0129.aspx

Thus, the need for Decentralized solutions.

Security and identity verification of the clients who use the app is paramount for us, and to thrive in this market we need this to emulate incumbents such as Bitso. We think our technology is mature enough if we compare with these incumbents and much safer.

Talking about the "promises" we made at the planathon phase, you can see that we have successfully completed them all.

Regarding the application we would like to test it with real Capital perhaps in Q4 2022, but on the side of features and coding we still need to go mainnet and to activate Rapyd's backend and we are set to go. Rapyd allowed us to create an application very similar to Rappi (https://www.rappi.com) in this sense as it is the same service they use and we have some experience developing on it.

Hopefully you liked the Mobile DApp, to see it in action in the future support it!